Away With Transaction Fee, Debit, Credit Cards

Aadhar Payment App – “IDFC Aadhar Pay” for Merchants

- 683 Views

- March 11, 2017

- By Admin

- in India, Technology

- 0 Comments

- Edit

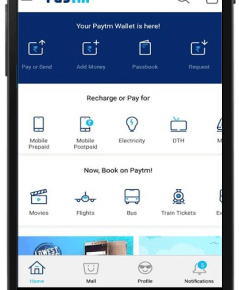

NEW DELHI: An Aadhaar-based app has been launched that will not only do away with the need to carry debit or credit cards, but also cellphones. For the consumer, what could be the most attractive feature of Aadhaar Pay is that it does not impose any transaction fee on the consumer. The android app — launched by IDFC bank — needs to be carried only by the shopkeeper. All the consumer needs to do is carry her Aadhaar number and mention the bank.

“There are no MDR (Merchant Discount Rate) charges here,” said Amitabh Kant, the Chief Executive Officer of think-tank NITI Ayog, who has been instrumental in pushing the Narendra Modi government’s less cash drive. The app is expected to popularise cashless transactions in small towns and rural areas, where consumers mostly do not have smartphones or debit and credit cards.

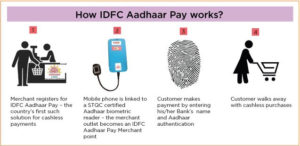

How will Aadhaar Pay work?

A shopkeeper must download the app on a smartphone that is connected to a biometric or fingerprint scanner. A customer will have to feed in his or her Aadhaar number and select a bank for payment. Biometric data will be scanned by the reader as the password.

How safe is Aadhaar Pay

The chief of Unique Identification Authority of India has assured that Aadhar Pay is as safe as any other mode of cashless payment. “This system is as safe as any other system of payment. In fact, my personal opinion is that it is safer than any other mode,” said Ajay Pandey, Chief Executive Officer of UIADAI, the agency that makes Aadhaar.

How many people can this help?

So far, 1 billion Aadhar numbers have been made and nearly 400 million Aadhaar numbers have been linked to bank accounts.

Currently Aadhaar enabled payment systems are being tried out in some rural areas as a form of cashless payment. Prime Minister Narendra Modi had launched it as part of the BHIM app launch. The government wants Aadhaar Pay to lead its less cash campaign.

![Launch of Satellite Aryabhatta – [April 19, 1975] This Day in History](http://www.witalive.net/wp-content/uploads/2020/04/Aryabhatta-380x290.jpg)